A.D. Cantelmo Property Management

Our Business is Property Management in Orange County California

Can you get around Private Mortgage Insurance (PMI)

For many borrowers

paying that monthly (PMI) Private Mortgage insurance is a burden and for many

who have good credit but don’t have the 20% down payment, it is frustrating to

have that extra expense every month. Is there a way to get around PMI?

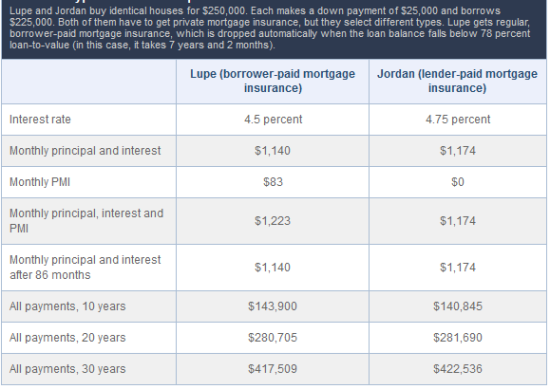

One program

that you may want to look at if you are in the position of having to pay PMI, is

Lender Paid Mortgage Insurance (LPMI). In this program the Lender pays the

Mortgage Insurance and the borrower has a higher interest rate. This can bring

your monthly payment down. There are Pro’s and Con’s to LPMI and you need to do

some research to see if it is a good program for your individual situation.

The Pro’s

for LPMI are, as mentioned, Lower monthly payments and the extra interest paid

is a Tax deduction and as of now PMI is not Tax deductible. The cons are that

in the long run you may actually pay more, because LPMI is never canceled and

PMI after you hit the 80% threshold you can cancel your PMI.

In my

business of Property Management in Orange County CA. it is important for my

clients to understand their options that can help them increase their profits.

Here is an example

A.D. Cantelmo Property Management Specializes in Property

Management on Orange County Ca.